when will estate tax exemption sunset

Before the Estate Tax Exclusion Sunsets in 2026. The current estate and gift tax exemption law sunsets in 2025 and the exemption amount will drop back down to the prior laws 5 million cap which when adjusted for inflation is expected to be about 62 million.

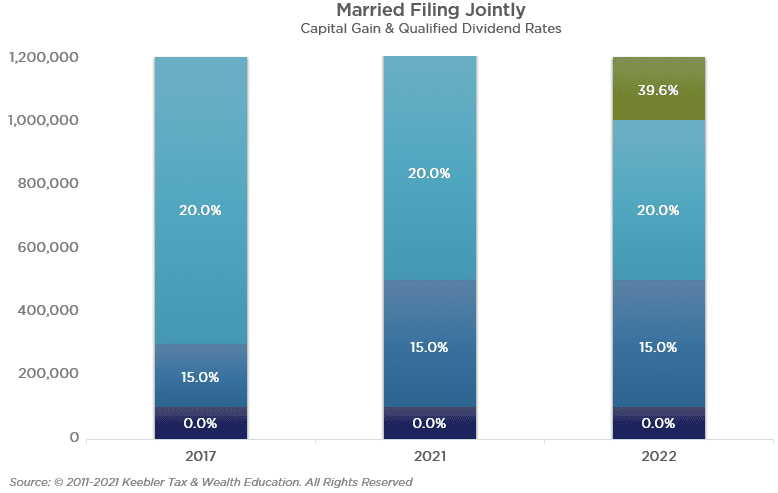

Gift Tax Exemption Lifetime Gift Tax Exemption The American College Of Trust And Estate Counsel

Its basically 11 million plus inflation adjustments.

. When the calendar turns to 2026 the estate tax provisions implemented by the Tax Cuts and Jobs Act TCJA are due to expire or sunset. As of this writing many states have already eliminated their state estate taxes although 17 states and the District of. The Build Back Better bill thats been bouncing around in Congress included a provision that would accelerate the sunset provision so that the.

Couples can pass on twice that amount or 228 million. Nothing has happened politically and the doubling of the estate and gift tax exemption is scheduled to sunset on January 1 2026 at the end of the 7 th year. After that the exemption amount will drop back down to the prior laws 5 million cap which when adjusted for inflation is expected to be about 62 million.

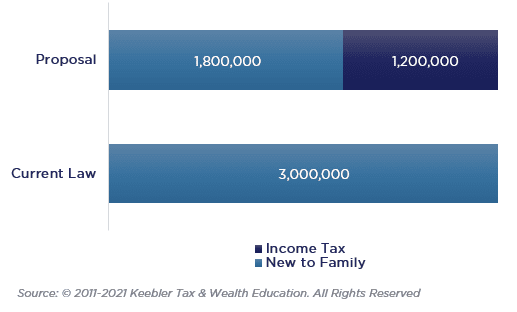

Unless your estate planning is completed and you have fully taken advantage of your lifetime gift tax exemption the amount of wealth you can transfer during your lifetime reverts to the 2017 threshold indexed to inflation. This higher exemption amount has continued to increase indexed for inflation and the exemption in 2021 is 117M. This means starting in 2019 people are permitted to pass on tax-free 114 million from their estate and gifts they give before their death.

2 In addition the 40 maximum gift and estate tax rate is set to increase to 45 in 2026. Importantly the current doubled base exemption value of 10000000 is slated to sunset meaning that it will revert to 5000000 effective January 1 2026 unless Congress acts to extend current law. Website builders As 2026 approaches families who have more than 10M or individuals with more than 5M may be served well from making more than 5M of completed gifts and utilizing the higher estate exclusions before they sunset.

The conversation often begins with a question from a client such as I understand that the estate tax exclusion amount is very high under current tax law but that it is scheduled to revert back to much lower levels in 2026 when the current limits sunset. The current estate and gift tax exemption is scheduled to end on the last day of 2025. The current estate and gift tax exemption law sunsets in 2025 and the exemption amount will drop back down to the prior laws 5 million cap which when adjusted for inflation is expected to be.

However the favorable estate tax changes in the TCJA are currently scheduled to sunset after 2025 unless Congress takes further action. Starting January 1 2026 the exemption will return to. You may recall that the 2017 Republican tax reform legislation roughly doubled the estate and gift tax exemption.

Making large gifts now wont harm estates after 2025. Notably the TCJA provision that doubled the gift and estate tax exemption from 5 million to 10 million adjusted annually for inflation will revert to pre-2018 levels after 2025. On November 26 2019 the IRS clarified that individuals taking advantage of the increased gift tax exclusion amount in effect from 2018 to 2025 will not be adversely impacted after 2025 when the exclusion amount is scheduled to drop to pre-2018 levels.

The grantor of the trust has the flexibility to forgive the loan prior to the sunset date and complete the gift. Proper planning may be necessary to make sure you are taking full advantage of the current exemption and arent negatively affected when it decreases. By Megan Russell on September 3 2020.

On December 31 st 2017 the Tax Cuts and Jobs Act TCJA doubled the federal lifetime gift and estate tax exemption from around 55M to about 11M. Its 1158 million for deaths occurring in 2020 up from 114 million in 2019. The federal estate tax exemption is indexed for inflation so it increases periodically usually yearly.

Its set to expire at sunset in 2025 so experts are advising entrepreneurs to strike now and create. The high amount is set to sunset at the end of 2025 but the impact of a global pandemic and the upcoming presidential election will likely accelerate the rollback. Under the current tax law the higher estate and gift tax exemption will Sunset on December 31 2025.

The size of the estate tax exemption meant that a mere 01 of estates filed an estate tax return in 2020 with only about 004 paying any tax. Exemptions are subtracted from the value of an estate and only the balance is subject to the estate tax. This resulted in a unified lifetime exemption of 11400000 in 2019 and 11580000 in 2020.

May 31st 2022. Although the vast majority of Americans have estates that fall under the estate and gift tax exemption the exemption is set to be cut in half in 2026. Until that time he or she had the option to demand payment or.

The proposed bill reduces the federal estate and gift tax exemption from 117 Million per person to 5 Million per person indexed for inflation prior to the scheduled sunset on January 1 2026. The estate-tax exemption rose to 1158 million in 2020 180000 higher than the year before. The current exemption doubled under the Tax Cuts.

After 2025 the TCJA is set to sunset and the exemption reverts to pre-2018 levels adjusted.

What Happened To The Expected Year End Estate Tax Changes

Estate Taxes Under Biden Administration May See Changes

Custom Build Luxury Home Kim Woodul Realtor Ebby Halliday Rockwall Heath Lake Ray Hubbard In 2022 Lake View Lake Lakefront

Eye On The Estate Tax Nottingham Advisors

What Will Happen When The Gift And Estate Tax Exemption Gets Cut In Half

New Regulations Affect Social Security Roth Conversions Tax Code Estate Planning And Much More Estate Planning Financial Planning Retirement Savings Plan

A New Era In Death And Estate Taxes

What You Need To Know About The 11 Million Estate Tax Exemption Going Away

New York Estate Tax Everything You Need To Know Smartasset

Will The Lifetime Exemption Sunset On January 1 2026 Agency One

Life Insurance Trusts Offer Discounts On Estate Tax Wealth Planning Estate Tax Life Insurance

Eye On The Estate Tax Nottingham Advisors

Charles Sampson Group Of Charter One Realty Hilton Head Island Sc Hilton Head Island Real Estate Agency

Federal Estate And Gift Tax Exemption To Sunset In 2025 Are You Ready Adviceperiod

Estate Tax Exemptions 2020 Fafinski Mark Johnson P A

Eye On The Estate Tax Nottingham Advisors

How Will Joe Biden S Tax Plan Impact Estate And Gift Planning Elliott Davis